For keen observers of the retail media landscape, IAB Europe’s July 2025 Attitudes to Retail Media Report offers a breathtaking view from 10,000 feet. Growth is almost everywhere you look, from the duration of retailer-brand partnerships to off-site and onsite (particularly CTV) advertising spend.

But the IAB report, based on a survey of over 180 advertisers, agencies, and retailers across 31 European markets, reveals a curious paradox: While brands and retailers are ramping up investment across the ecosystem, spending on in-store digital advertising stubbornly lags behind that of every other channel.

Seen from above, however, the findings suggest that Europe’s retail media sector is not just in a period of rapid growth but critical transformation, as key stakeholders begin to embrace a holistic omnichannel strategy that could finally unlock in-store’s massive potential.

Europe’s In-Store Disconnect

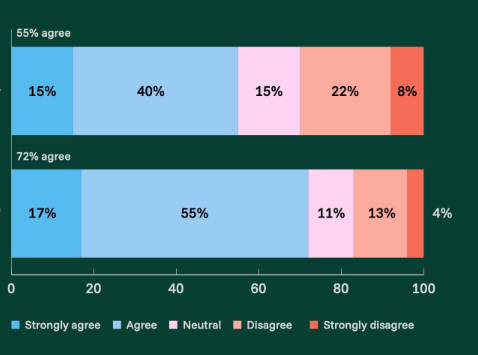

When it comes to in-store, the IAB report shows a sharp disconnect between potential and investment. Despite 70% of retailers now offering digital screen inventory and the fact that 79% of advertisers prioritize reaching shoppers at the point of sale, nearly half of buyers (48%) report zero digital advertising spend in physical retail environments.

This underinvestment contrasts with sharp growth across other retail media channels. Over 90% of buyers maintain substantial on-site investment, while off-site spend has surged dramatically—46% of buyers now allocate more than 41% of their digital spend to off-site channels, up from just 30% in 2024.

Why the mismatch between in-store priorities and budget allocation? It suggests a misreading of in-store’s potential to drive results across the full funnel, says Alison Dunham, Sales Director of In-Store Retail Media at PRN, a STRATACACHE company.

But before attitudes can shift, key stakeholders in in-store digital will need to present their receipts. “The onus is on retailers and their agency partners to show the full scope of what is achievable by way of shopper insight data in addition to attributable behavioral change and increased sales,” says Alison.

Will Omnichannel Open the Door?

Beneath the IAB report’s surface statistics is evidence of a more sophisticated, integrated approach to retail media emerging across European markets. The research shows that brands are moving toward holistic strategies that could soon unlock in-store potential.

Partnership duration has increased significantly, with 63% of stakeholders now maintaining retailer relationships for more than a year, up from 50%. This shift toward longer-term engagement suggests brands are thinking strategically about retail media ecosystems rather than treating channels as siloed opportunities.

Brands are also diversifying their retail media portfolios, with those working with four to six networks more than doubling from 10% to 24%. This jump reflects not only the fragmentation of the current landscape but also brands’ recognition that comprehensive consumer reach requires multiple touchpoints. The trend toward omnichannel strategy bodes well for future in-store digital investment.

Closing the Measurement Gap

The challenge of measurement and attribution remains a major obstacle for in-store digital. While Return on Ad Spend leads metric demand at 88%, only 71% of networks currently offer ROAS reporting, the report finds. For in-store retail media, granular measurement standards and capabilities are still evolving, creating hesitancy among retailers and brands accustomed to precise digital tracking.

And that granular measurement is what buyers want and need, the report finds. First-party data activation and omnichannel integration now lead their strategic priorities at 39% each, but incrementality measurement follows close behind at 37%. The takeaway is clear: The convergence of digital precision with the strategic appeal of physical proximity could rapidly accelerate the growth of in-store investment.

The 85% of retailers now offering some form of in-store digital advertising—up from 72% in 2024—indicates growing recognition of the channel’s strategic value. But future success depends on demonstrating clear ROI through sophisticated attribution models and creating compelling consumer experiences that justify premium pricing.

The question isn’t if or when brick-and-mortar digital advertising will integrate into omnichannel strategies—it’s how quickly measurement and standardization challenges can be resolved to unlock the potential of retail media’s most untapped frontier.