The message is loud and clear: Standardized, reliable in-store data measurement is a “must-have” for the retail media sector—and it’s needed ASAP. That’s the takeaway from two comprehensive industry studies released in July 2025, the IAB Europe’s Attitudes to Retail Media and the ISBA Digital Retail Media Study.

In itself, the need for granular, sophisticated in-store data measurement is not news. What is striking is that both reports highlight the urgency for achieving this enhanced capability.

“While digital screens with advertising in retail are becoming more prevalent, measurement is still an opaque patchwork quilt of methodologies and data sources,” explains Chuck Billups, Global Head of Retail Media Advertising at PRN, a STRATACACHE company. “This hinders in-store retail media from evolving to the true mass media vehicle that it has the potential to be.”

What’s more, both reports point to the wider value of in-store measurement for the sector as a whole, where channel fragmentation is a nagging strategic hindrance. They compellingly make the case that enabling reliable in-store measurement will eliminate investment barriers and unlock significant value for brands and retailers across the entire retail media ecosystem.

The Measurement Imperative

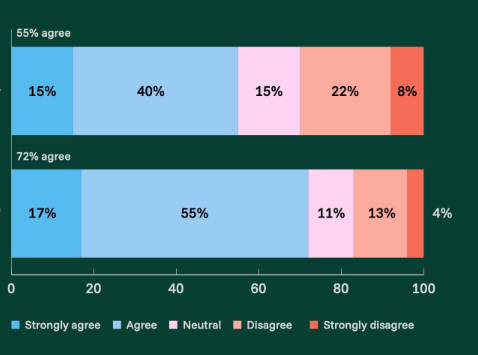

The in-store investment gap is stark, the IAB report reveals. Nearly half of all buyers (48%) are spending zero dollars on digital ads in physical retail environments, according to IAB. Meanwhile, over 90% are allocating at least 41% of their budgets to on-site channels.

That represents a significant opportunity gap, especially considering that as much as 80% of all retail spending still occurs in physical stores. What’s more, the IAB report finds that 79% of respondents now prioritize “reaching shoppers at the point of sale” – up from 74% in 2024.

The ISBA study, which surveyed more than 25 industry stakeholders including major brands, retailers, agencies, and tech partners, strongly echoes this finding. It reports that enhanced measurement would strengthen all four strategic reasons companies invest in retail media: sales strategies, defensive positioning, performance growth, and brand building.

In fact, reliable, standardized in-store measurement may be the missing piece of today’s retail media puzzle, the studies suggest. Network fragmentation affects 51% of buyers, while 53% cite lack of standardization as a concern, according to IAB. Measurement leads the list of areas most requiring standardization at 78%, with attribution following at 69% (IAB).

For brands and advertisers, enhanced in-store measurement would deliver a huge boost, the studies find. They would gain the closed-loop attribution necessary to justify increased investment in these campaigns. This is particularly valuable given that 43% are already funding retail media through hybrid models that combine reallocated and new budgets, according to IAB. The ability to track consumer journeys from digital impression to in-store purchase represents a gold standard for campaign optimization.

Retailers also stand to gain substantially. While 70% already operate digital screens (with the proportion offering no in-store media dropping from 28% to just 15% in one year), those who can tap sophisticated measurement capabilities will be able to leverage that data for smarter, better targeted campaigns and to command premium pricing.

Where Measurement Is Needed Most

The impact of in-store digital ads on the store visit is top of mind for brands and retailers, but the data on the return on ad investment over the long haul is an even higher priority, the studies find.

Return on Ad Spend (ROAS) leads metric demand at 88%, according to IAB, yet only 71% of networks currently offer this fundamental metric. This gap is more pronounced in physical environments, representing both challenge and opportunity for forward-thinking retailers and technology providers. “The drumbeat is growing for incrementality and incremental ROAS (iROAS), but the industry can’t even agree whether ROAS is the right metric,” notes Chuck.

But, when measurement standards and capabilities are in place, in-store could be the best channel to actually measure it. “Certainly, outcome-based measurement is in-store media’s secret sauce,” Chuck says. “With proper implementation we not only can gather real impression data that is better than anything else across the media measurement universe but also run large scale iROAS studies between ad aware and non-ad aware with zero signal loss.”

Charting the Path Forward

Technological advancement will be key to in-store measurement capability, and on that front, the pieces are falling into place. “We need real in-store sensor-based measurement systems implemented that move beyond survey-based impression multipliers and assumed area visitation and dwell times,” says Chuck. “These systems are now available on every screen and have moved beyond privacy-scary cameras.”

A framework for measurement standards is just as crucial, and currently under review by the IAB. Meanwhile, the ISBA study advocates for customizable definitions rather than rigid, cross-category standardization. Different retail channels require bespoke approaches, and this flexibility could accelerate adoption while maintaining measurement integrity.

And what’s in store for in-store when capabilities and standardization come to fruition? Data connecting digital exposure to store visits. Standardized viewability protocols for in-store displays. The ability to integrate loyalty program data with advertising metrics. Real-time foot traffic measurement and cross-channel testing are also on the horizon.

The question is not if, but when. From his vantage at PRN, Chuck sees snowballing momentum toward in-store measurement maturity. “I think we are at an acceleration point,” he says. “We are installing sensor-based measurement everywhere, and we are rolling large-scale in-store deployments at the largest retailers in the world. The ubiquity of these systems will transform the industry over the next three to five years.”