By 2028, in-store retail media investment is projected to top $1 billion, and marketers are highly confident that they know where, when and how to spend those ad dollars to get the most bang for their brands’ bucks.

But what if that confidence is overinflated? It may be, according to “Perception vs. Reality: The In-Store Advertising Disconnect,” a comprehensive joint study by EMARKETER and Placer.ai, which reveals that marketers are fundamentally misreading the impact of in-store digital advertising on consumer behavior.

Fascinatingly, the survey of 286 marketers and 1,143 consumers finds that marketers aren’t the only ones falling into the perception versus reality gap. Consumers also misjudge the impact of digital advertising on their own shopping patterns.

Most revealing of all, the study finds that, even when in-store digital ads don’t result in an immediate purchase, their influence can pay off over the long-term. By following that North Star, as well as acting on other insights uncovered by the study, marketers can course correct their retail media strategy to align with shoppers’ real behavior.

The Influence Paradox

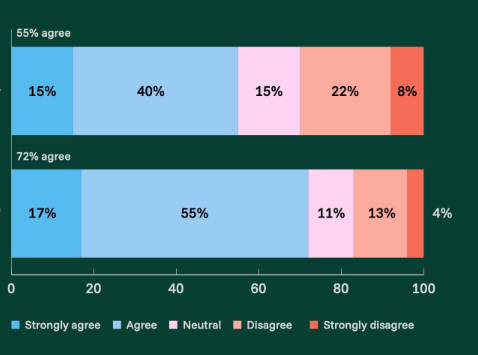

The disconnect starts with a shared misperception about the power of in-store ads’ influence. Marketers believe 71.3% of consumers are moved by in-store digital advertising to make immediate purchases, while only 32.3% of consumers actually report being influenced—an eye-popping 39% gap.

But while marketers overestimate the on-site impact of digital ads, consumers consistently underestimate their own susceptibility to their influence. Only 24.5% of shoppers claim they would make an unplanned purchase after seeing an in-store ad, but nearly double that number—48.6%—report they have put products in their carts after viewing an ad in-store.

Are consumers unaware of advertising’s influence or just reluctant to acknowledge its ability to unconsciously guide their shopping decisions?

Maybe both, says Suzy Davidkhanian, Vice President of Content at EMARKETER. “Consumers can do many steps in one trip or take months between first learning about a product to making the purchase, so it is no surprise that consumers have a tough time attributing in-store advertising as a touchpoint that helped sway them,” she explains.

Playing the In-Store Long Game

Marketers and consumers are aligned on one retail media strategy: the power of on-site promotions—but even here, the perception gap persists. Both agree that discounts, sales and special offers are the most effective drivers of unplanned purchases, but marketers still overestimate their impact. While 75.5% of marketers believe discounts seal the sale, only 49.3% of consumers say promotions move them to make a purchase.

The reality is more nuanced, the study finds. While 53.9% of consumers say discounts would entice them to make unplanned purchases, their actual behavior shows they’re influenced by a broad range of conscious and unconscious factors. This suggests that even when marketers identify the right strategy, they may be overinvesting in discount-heavy messaging at the expense of other approaches with greater payoff.

Simply put, marketers overvalue in-store ads’ immediate impact while undervaluing their long-term impact. Only 24.5% of consumers make immediate purchases after seeing an in-store ad, but the study finds that an ad’s value extends far beyond a single trip. A remarkable 44.3% of consumers research a product or brand later after encountering an in-store ad, while 29.8% actually purchase the product during later shopping trips.

How Marketers Can Close the Gap

While the study offers marketers a reality check on their skewed perception of shopping patterns, it also points them toward in-store retail media strategies that will be truly effective moving forward.

Rather than solely valuing an in-store ad’s impact on immediate sales, they can and should embrace data measurement that captures long-term influence. This includes tracking delayed purchases and brand awareness lift. It also means researching longer-term shopping behavior that consumers themselves don’t attribute to exposure to a single in-store ad.

The disconnect between marketer perception and consumer reality is not just a challenge; understanding it is a golden opportunity to refine and improve in-store retail media strategy. By aligning in-store retail media ad spend with actual consumer behavior—as well as consumers’ own blind spots about ads’ influence—marketers can create in-store advertising that drives results for brands both at the checkout counter and for years to come.