Retailers Get Real: Carrefour’s Approach to In-Store Retail Media Networks

Retail media networks (RMNs) are evolving rapidly, with in-store activations taking centre stage as brands and retailers seek new ways to monetise physical spaces. At What’s In Store for Retail Media Networks 2025 presented by STRATACACHE in partnership with NRF, Daniel Knapp, Chief Economist at IAB Europe, sat down with Alexis Marcombe, CEO of Unlimitail, the retail media joint venture between Publicis and Carrefour. Their discussion revealed how Carrefour is capitalising on the in-store opportunity and why Europe’s approach to RMNs differs from the U.S.

Europe vs. the U.S.: A Different Path to In-Store Retail Media

Retail media in Europe faces a unique set of challenges compared to the U.S. market. While the U.S. benefits from large e-commerce players that drive digital retail media, Europe’s fragmented retail landscape lacks dominant online players. Instead, European retailers have historically relied on strong physical store footprints to drive business.

According to Marcombe, this distinction has led European retailers to focus on in-store retail media much earlier than their U.S. counterparts. While U.S. digital retail media is significantly larger in scale, the in-store retail media markets in both regions are nearly equal, with each generating approximately $300–400 million in media spend.

In-Store: The Last Mass Media Opportunity?

For Carrefour, the in-store opportunity is clear — reach. The retailer engages 70–75% of households every week through its 14,000 stores worldwide. As Marcombe put it, “We are mass media. One of the last [forms of] mass media.”

Despite these massive audiences, in-store retail media remains significantly undervalued. Marcombe noted a stark gap (what he called “a canyon”) between the revenue generated from online retail media and in-store retail media. While leading retailers generate up to 2% of their gross merchandise volume (GMV) from online retail media, in-store retail media currently accounts for just 0.15% of store sales. The reason? Measurement.

The Key to Unlocking In-Store RMN Growth: Data and Measurement

Marcombe emphasized that retail media is fundamentally about performance, and performance requires measurement. Many retailers struggle to track in-store activations effectively, which limits their ability to prove ROI to brands. To address this, Carrefour has invested heavily in measurement infrastructure, leveraging loyalty data as a key identifier — what Marcombe described as “the new cookie.”

By integrating loyalty data across its stores, Carrefour can offer brands clear attribution and insights into how in-store activations drive sales. This data-driven approach aligns retail media with performance marketing principles, making it more attractive to advertisers who traditionally prioritise digital channels.

The Future of In-Store Retail Media: Omnichannel and Automation

Looking ahead, Carrefour sees omnichannel strategies as the key to maximising the value of in-store RMNs. The goal is to create a seamless experience where there is no distinction between online and offline activations. According to Marcombe, “If you’re able to play omnichannel, real omnichannel, meaning there’s no frontier between your website and your stores, then you’ll win.”

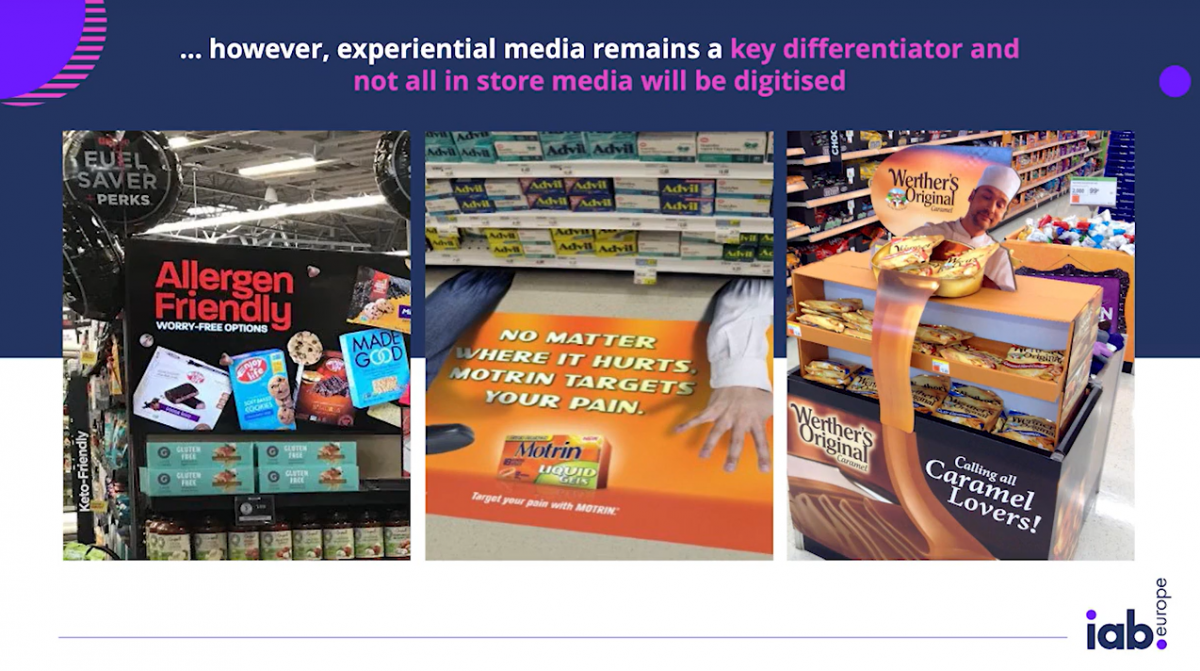

Additionally, Carrefour is rapidly digitizing its stores, installing thousands of digital screens to support programmatic buying and real-time ad delivery. However, Marcombe was quick to note that digitalizing stores isn’t just about adding screens — it’s about integrating a data-driven approach that allows retailers to automate media buying, optimize campaigns, and improve customer experience without overwhelming the store environment.

The Bottom Line

As retail media continues to evolve, Carrefour’s in-store strategy highlights a key shift in how retailers and brands approach physical spaces. By prioritizing measurement, leveraging loyalty data, and embracing omnichannel strategies, Carrefour is proving that in-store retail media is not just a legacy channel — it’s a core component of the future of retail advertising.

Watch the full discussion here.

What’s Next?